Pharmaceutical Industry Restructuring Results in Increased Outsourcing

Outsourcing in pharma industry helps keep costs under controlThe pharmaceutical industry is in the throes of a massive sea change, one that will undoubtedly impact human health for decades. Due to forces such as the need to curb drug development and operational costs, dealing with a troubling skills gap across the industry and other factors, biopharma companies have been restructuring their businesses. Often, operations are outsourced. Business units are sold off, merged or restructured.

Only a few short years ago, R&D was still done in house and a limited amount of drug development and/or manufacturing was outsourced to a partner. As time progressed, biopharma industry consolidation and intense pressure from competition began to alter the pharmaceutical market. Currently, pharmaceutical companies are turning over work in more challenging technical areas to third party contract partners. The third party partner organization then handles more of the responsibilities for documentation, regulatory compliance and supply chain management. With pharma and life sciences regulations changing across the world, regulatory compliance is now much more complex than in previous decades. Today, drug manufacturers that outsource operations are no longer focused on a transactional relationship but rather on developing real partnerships with organizations with seasoned expertise and a deep bench workforce.

Across the world, the pharma sector continues to experience noticeable layoffs. Looking at the picture in its totality, this is not a sign of trouble but rather a significant shift in the manner in which pharmaceutical companies do business. From pharmaceutical sales representatives to scientists, jobs have been lost, however, continued movement towards third party companies to fulfill key needs in manufacturing, drug development and warehousing and logistics results in labor resources being absorbed by third party providers. Consequently, the pharmaceutical outsourcing industry is flourishing.

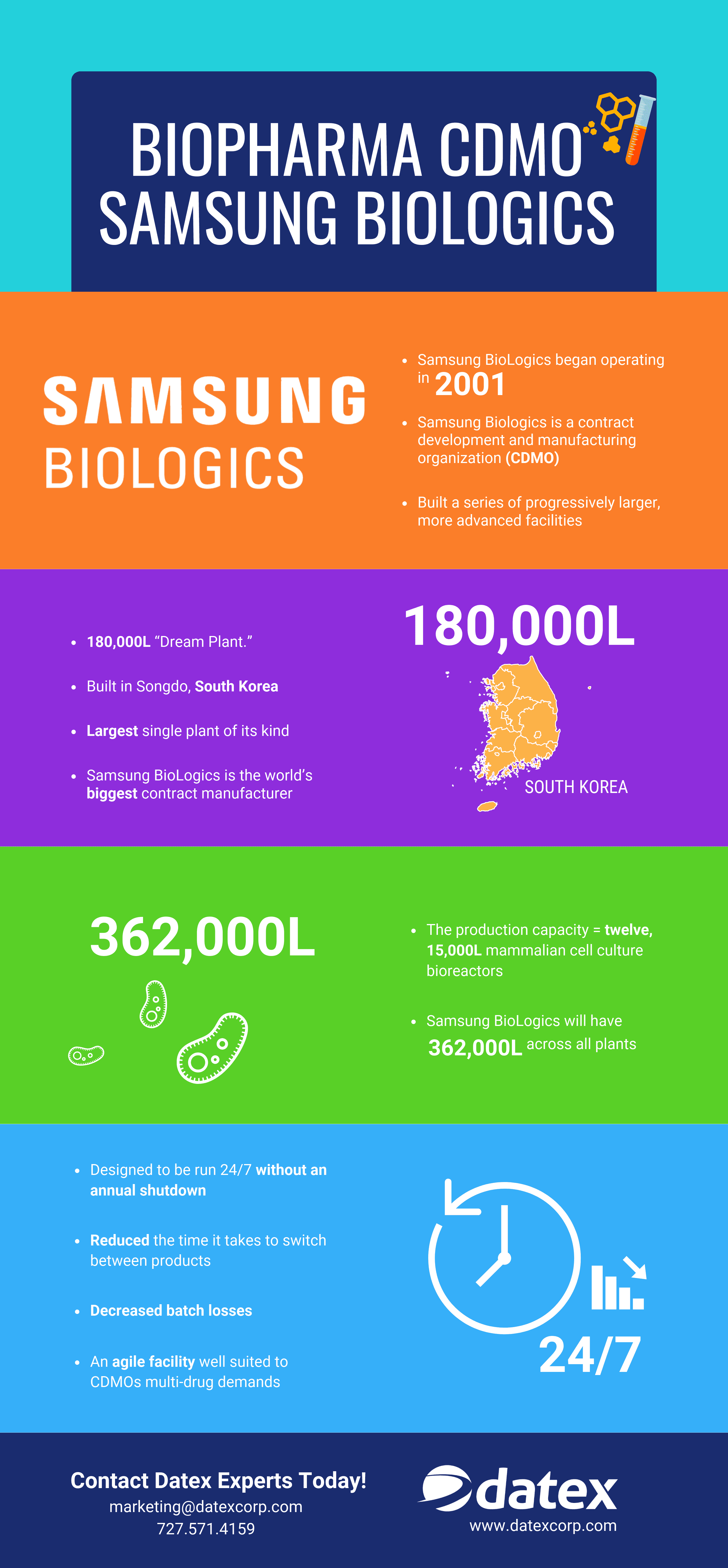

Open positions which used to be found at major drug companies are now available at contract research organizations (CROs), contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs).

Here are some of the biopharma companies that announced restructuring in the past three years:

Pfizer

Bayer AG

Selecta Biosciences

Eli Lilly

ASLAN Pharmaceuticals

Aduro Biotech

Bristol-Myers Squibb

The top drivers behind the major trend of outsourcing in the pharma industry are:

1. Need for increased flexibility of commercial scale

As the biopharma industry changes to meet market and patient needs, having the agility to scale operations is essential. Pharma companies need to be able to scale services and operations, adjust resources and alter their concentration to remain competitive.

2. Adoption of new technologies and infrastructure

According to an industry study by Pharmaphorum, 49% of pharma survey respondents reported that use of proven external technologies is an important factor when selecting an outsource partner. Pharma companies view the outsourcing relationship as partnership-driven and a valued element of their business strategy. The outsourcing pharma partnership enables the pharma company to have access to market leading technologies needed to fuel commercial success.

3. Fills skill gaps in biopharma organizations

Pharmaceutical industry trade group PhRMA forecast that two million jobs will remain unfilled between 2015 and 2025, primarily due to STEM talent shortages. The Coalition of State Bioscience Institutes surveyed 354 life sciences hiring managers and human resources professionals early last year. The survey revealed that over 20% of respondents reported that manufacturing-related jobs such as engineering and quality were difficult to fill. Jobs in clinical research and R&D are also problematic to fill, partially due to intense competition as the sheer number of clinical trials has increased exponentially over the past 20 years.

Introduction of leading edge technologies such as artificial intelligence (AI) and real world data analytics are anticipated to aid in execution of clinical trials and improve competitive advantage for life sciences companies. To utilize these technologies, pharma companies need tech-savvy employees on their research teams. This pool of candidates is often the same as those in data science areas hunted by major players including Google and Amazon.

Benefits of outsourcing operations to CMOs, CDMOs and CROs:

- Minimizes capital investments

- Decreases drug development costs

- Reduces overall operating and drug development costs

- Speeds up drug development

- Enables biopharma companies to focus more on marketing

- Facilitates compliance with regulations across the world

As old drug product franchises encounter financial pressure from generic drug competition, global biopharma companies are looking for new opportunities. Restructuring programs by biopharma enterprises within the past two to three years have resulted in the downsizing of personnel, changes in R&D efforts and concentration, closure of manufacturing facilities and sell-off of poorly performing operations and business units. It has also resulted in increased outsourcing.

Pharmaceutical research and development (R&D) operations are costly, time consuming and efforts are not guaranteed to produce an effective, marketable drug product. Did you know that the average cost of developing a new drug product can be in the billions of dollars with an average development time of 10 years to bring the new drug to market? Add to this the factor that many drug products that are developed are not clinically effective, so they never reach the market. This represents a loss to the drug manufacturer.

The huge investment of time and money have resulted in pharmaceutical companies becoming reticent to use company-owned facilities for drug R&D. In order to save money, pharmaceutical companies often outsource drug development in order to mitigate their financial risk. This has resulted in increased demand for contract research organizations and fresh, new technologies.

What are global biopharma companies outsourcing?

Here are the four major areas:

- CMO: Contract Manufacturing Operations

- CDMO: Contract Development and Manufacturing Organization

- CRO: Contract Research Organization

- CTL: Contract Testing Laboratory

CDMOs in 2019

Startup biopharmaceutical companies often find it challenging to raise capital and build manufacturing supply chain facilities. Recruiting a workforce filled will skilled quality control (QC), manufacturing, supply chain, operations, manufacturing

As with the pharma industry as a whole, upheaval is present in outsourcing organizations. The greatest potential for downsizing in

Emerging biopharma companies tend to depend upon external financing for the majority of their development spending. This money flows through both CDMOs and CROs. If executives fear an inability to raise more money, they may elect to reduce spending. This may result in a situation similar to that of the 2008 financial crisis. The good news is that sentiment can change rapidly along with market conditions.

Market corrections on biopharma companies have been significant, partially driven by private equity firms competing to gain access to this rapidly expanding market. In 2017 and 2018, CDMOs were traded at multiples as high as 15 times EBITDA (earnings before interest, taxes, depreciation and amortization). However new market corrections have established a new, lower benchmark for valuations.

In comparison with the market in and biopharma generally as well as with clinical CROs, CDMO stock prices have dropped more precipitously. This may help to attract new investors and spur CDMO merger and acquisition (M&A) activity in 2019. With lingering concerns over rising interest rates and valuation changes, CDMOs are likely to be eager to improve performance. Major biopharma companies including Catalent, Famar and Recipharm have already closed or sold off underperforming or marginal facilities in order to enhance profitability and put their respective businesses in the best light.

Contract Research Organizations (CROs)

The most common biopharma products are outsourced for development (as of 2018):

- Vaccines (51%)

- Blood factors (46%)

- Hormones (44%)

Antibody drug conjugates (42%)

By 2026, drug discovery outsourcing is anticipated to increase to become a $43.7 billion industry. The outsourced pharmaceutical services industry has experienced a huge influx of capital.

A CRO may provide full services for biopharma companies from the point of drug discovery and structural analysis to execution of phase 4 clinical trials. Testing is one of the major functions of a CRO. Before a drug can go to market, clinical trials must be conducted in highly controlled environments.

In addition some biopharma companies which are not CROs offer specific outsourced services including:

- Identification of drug compounds using cell and biochemical-based profile techniques

- Assaying compounds or formulations

- Assistance with cell engineering projects

- Assistance with cell engineering projects

- Development of drug formulations

- Peptide and protein bioanalysis

How Using a 3PL Pharma Warehouse Management System Can Help CDMOs, CMOs, CROs and CTLs

- Enables flexibility in operations including

- inventory management

- manufacturing

- packaging

- re-packaging

- quality assurance

- quality control and more

- Helps facilitate cGMP compliance

- Maintains full lot genealogy and tracks individual product units

- Streamlines batch release process

- Streamlines operations with barcodes or RFID

- Facilitates printing of product identity labels with product information

- Provides seamless flow of

real time , accurate information across the enterprise and supply chain - Manages storage and shipment conditions

- Accurately handle complex nature of

third party billing with robust flexibility - Enable ready scale up or down of operations

Conclusion

For decades, drug manufacturers have changed the lives of people across the world and aided in extending life expectancy for those with conditions including heart disease, high blood pressure

Today,

Outsourcing operations including manufacturing, research

A pharmaceutical industry overview reveals an uptick in outsourcing, one that is likely to persist for years, given current and anticipated market forces.

What Makes Datex Different?

1. Revolutionary low code/no code flexible workflow-driven warehouse management software

2. Most configurable, user-friendly WMS on the market today

3. End-to-end solution provider: software, hardware, EDI, and managed services

4. White Glove Concierge Service

5. Executive-level attention and oversight