Onshoring U.S. Pharmaceutical Manufacturing: COVID-19, Congress and Puerto Rico Pharma Hub

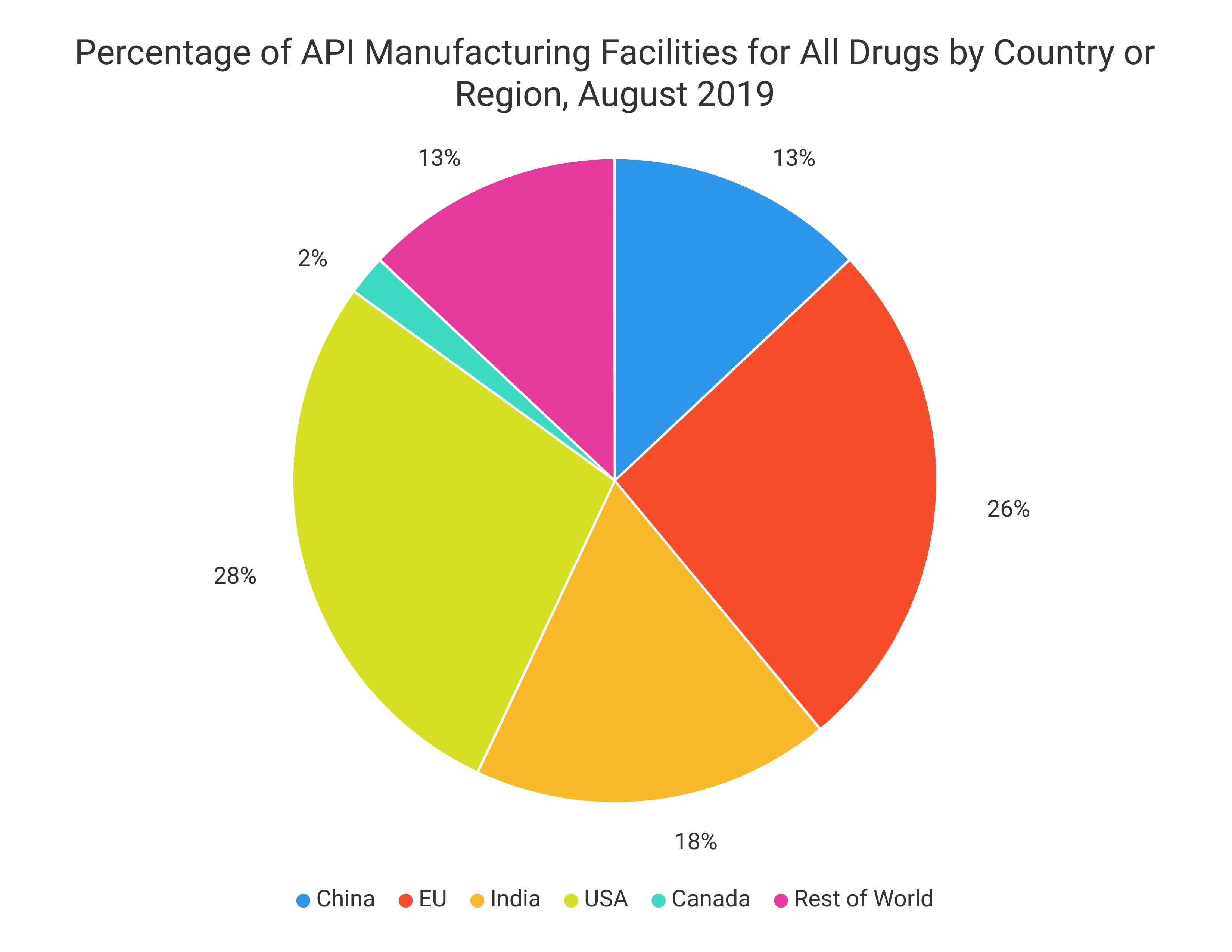

Ideas for returning pharmaceutical manufacturing to the U.S.With its significant investment in biomedical research, the United States is one of the foremost leaders worldwide in drug discovery, research and development, however, it is no longer as prominent in drug manufacturing. Over the past few decades, drug manufacturers have gradually moved production offshore. This trend is especially notable in the field of the manufacture of active pharmaceutical ingredients.

Pharmaceutical manufacturer’s need for large factory sites often comes with environmental liabilities, labor accessibility and labor costs are two of the most notable reasons for this shift. Today’s technology-enhanced complex pharmaceutical production facilities offer high-value manufacturing-related positions including quality and engineering but these positions, although critical, often are the most challenging to fill. According to the industry trade group PhRMA, approximately two million positions will remain vacant between 2015 and 2025 primarily because of the shortage of STEM talent. According to the Bureau of Labor Statistics, 450,000 jobs in manufacturing remained unfilled, a jump up from 100,000 during the last recession. Many of this is due to the need for workers with STEM backgrounds (science, technology, engineering and mathematics). The manufacture and process discipline of today’s innovative pharmaceutical products is more complex than that of generic solid dosage prescription drug products. Manufacturing is now much more advanced than it was years ago but lacks the skilled labor resources to power it.

COVID-19 Put a Spotlight on the Need to Onshore Drug Manufacturing Back to the U.S.

The COVID-19 global pandemic has shifted American attention to the importance of shifting the country’s dependence on other countries such as China and India for active pharmaceutical ingredients (APIs), medical devices and pharmaceutical product finished goods back to the United States. During the COVID-19 outbreak, the threat of disruption of pharma supply chains and drug shortages have loomed. As country after country started to close their borders, the risk to the pharmaceutical supply chain became more real, resulting in strategy sessions and negotiations to find ways to bring pharmaceutical manufacturing back to the United States.

Here are some sobering facts:

- According to the Council of Foreign Relations, nearly 90 percent of the generic prescription drugs that Americans take are exported from China and India. India provides 40 percent of the generic prescription drugs and over-the-counter drug products used in the U.S.

- India imports three-quarters of the APIs needed for its generic drug product formulations from China.

- The FDA currently believes that approximately 90 percent of the active pharmaceutical ingredients utilized by American biopharmaceutical manufacturers are exported from China.

- China supplies over 95% of the U.S. market for vitamin C and antibiotics.

The Action Plan

United States legislators as well as the public have become alarmed about American reliance on foreign suppliers of prescription drugs, medical devices, medical supplies and medical equipment. The worldwide pandemic forced open the eyes of the world on the chokehold that specific countries have on other nations in terms of APIs, generic drugs, antibiotics and other products essential to human health. In Congress, the debate has reached a fevered pitch at times as legislators have voiced concerns that this issue is one of national security.

Strategies to Return the Pharmaceutical Industry to the United States

1. “The Nudge”

The White House has noted that it is preparing an executive order to “close loopholes” which would enable the government to purchase medical devices, PPE and medical supplies and medical equipment from foreign countries. It has been reported that this executive order would mandate that U.S. government agencies must purchase American-made medical products. The executive order may eventually be expanded to include pharmaceuticals but has yet to be finalized.

Through the executive order, the administration hopes to call attention to the increased demand to “nudge” medical and pharmaceutical industry manufacturers to return production to the United States. Unfortunately, as U.S. generic drug pricing has dropped and the amount of generic drug producers has increased widely across the world, American generic drug manufacturers have been forced to sell off or close facilities in order to focus on more lucrative specialty pharmaceuticals. This is one area of pharmaceutical manufacturing that will be especially challenging to return to the U.S.

It is important to note the power of pharmaceutical industry lobbyists on Capitol Hill, the largest of which is the Pharmaceutical Research and Manufacturers of America (PhRMA). Thus far, PhRMA has voiced its disapproval of massive changes to the pharmaceutical supply chain. PhRMA has reasoned that manufacturing in the United States would be much more costly as production and labor costs are significantly lower overseas and the U.S. lacks the requisite number of STEM graduates. This effort would also disrupt already established pharma global supply chains.

Another issue of concern is product quality. China and India, two of the world’s largest centers for pharmaceutical manufacturing and the two countries most often cited by the FDA for quality control issues.

2. Introducing Advanced Manufacturing Technologies

According to the FDA, advanced manufacturing technologies including continuous manufacturing, 3D printing facilities can play a vital role in enhancing drug product quality, enhancing the drug manufacturing process, addressing the shortage of medicines and expediting the time-to-market. Industry news is abuzz with advancements in 3D drug manufacturing by major companies including GlaxoSmithKline Plc., Hewlett Packard Enterprise and Aprecia Pharmaceuticals, for example.

Just as artificial intelligence is being used to advance research and development of new drug products, other advanced technologies are proving their worth in advancing pharmaceutical manufacturing. Although most drug products tend to be manufactured in mass quantities using conventional methods utilizing large-scale production processes, equipment and extensive production time, emerging technologies are showing promise in transforming drug manufacturing.

3-D Printing

3-dimensional printing (3D) is especially of interest in producing personalized medicines in solid dosage form. Ideal for utilizing physical properties, the 3D printing process can be used to manufacture solid drug products in a variety of shapes, geometric designs and strengths. Using 3D printing enables the spatial distribution of the active and inactive drug ingredients during the manufacturing process. In addition, 3D printing structures can create designs that range from a single compartment design to complicated multi-compartmental designs. Another specific benefit of using 3D printing in drug manufacturing is that it can tailor the release profile of the active ingredient from the 3D complicated drug products so that it can meet the specific needs of the patient.

- Capable of combining specific medications into one “polypill” to make it easier for patients to take multiple medications needed for chronic conditions, by the elderly, etc.

- Can customize dosage forms such as for special or smaller doses needed by children or older adults

- Able to enhance the performance of a drug product by manufacturing using a 3D design to control release or performance

- Can product unique dosage forms with characteristics which are unachievable in conventional dosage forms. This includes instantaneous disintegration of an active ingredient as well as other more complex drug release profiles.

- Ideal for special populations with unusual or changing medical needs

3. Congressional Bills

- “Protecting our Pharmaceutical Supply Chain from China Act” sponsored by Senator Tom Cotton mandates that by 2022 all government payers phase out reimbursement for drug products that are either sourced or manufactured in China.

- “Strengthening America’s Supply Chain and National Security Act” sponsored by Senators Rubio, Warren, Cramer, Murphy and Kaine. The plan would leverage the Department of Defense (DoD) to identify the full extent of American dependence on foreign entities for API, pharmaceutical components and drug products and determine if this qualifies as a national security issue. Drug manufacturers would be legally obliged to provide the FDA with information regarding APIs and the volume used in each drug product manufactured. The legislation would mandate that the country of origin specified in the “Buy American Act” would be based on where the APIs and other components originate and not on where the final product is manufactured.

- “Securing America’s Medicine Cabinet (SAM-C) Act” sponsored by Senators Bob Menendez and Marsha Blackburn seeks to increase the amount of API-producing facilities in the United States by encouraging partnerships of pharmaceutical manufacturers with the “best minds in higher education.” The partnership would seek to leverage new advancements similar to those in other industries, expand on the FDA Emerging Technology Program and find ways to increase U.S. production of vaccines and drugs to save lives. The SAM-C Act would authorize $100 million to develop centers of excellence in the field of advanced pharmaceutical manufacturing, partnerships between the private sector and institutes of learning. This would help to drive innovation as well as to train the workforce needed for pharmaceutical manufacturing.

- “Manufacturing API, Drugs and Excipients (MADE) Act” sponsored by Representative Buddy Carter and Senator Tim Scott incentivizes drug manufacturers that return production to the United States. The incentives provided are tax credits that would be granted via federal Opportunity Zones. This legislation has adopted the position of the Association for Affordable Medicines (AAM), the biggest lobbyist for the generic drug industry. The AAM has already published a list of generic drugs that it considers to be the most critical generic drugs that should be made in the United States. AAM advocates that the authority of HHS be expanded to identify critical medications and aid in offering incentives for pharmaceutical industry reshoring. The idea is to develop a network on reliable, cooperative U.S. manufacturers largely by having HHS leverage financial tools to fuel viable investments. The tools include loans, grants, tax incentives and guaranteed price and volume contracts.

4. Another Strategy: Ramp Up Puerto Rico as a Pharmaceutical Industry and Medical Manufacturing Hub

Rumors of discussions involving the consideration of restoring some version of the Section 936 tax break exempting pharmaceutical manufacturers from corporate taxes in Puerto Rico or at least a competitive lower tax rate and/or creating a form of “most-favored nation” type status for Puerto Rican tax rate for pharmaceutical intellectual property have been noted.

After Section 936 was phased out, many pharmaceutical companies moved their manufacturing facilities to Ireland. Ireland offers a low 6.25% corporate tax rate for revenue that is tied to intellectual property including patents. This has proven to be a significant growth driver for Ireland over the past twenty years.

Puerto Rico has a long history of success in attracting and retaining life sciences manufacturers and in 2019 was the third-largest biotechnology manufacturer in the world. As a manufacturing hub, Puerto Rico is home to 11 of the top 20 global pharmaceutical companies. More than half of the world’s top 10 bestselling prescription drugs are manufactured in Puerto Rico.

In terms of United States pharmaceutical manufacturing, Puerto Rico is the top pharma exporting region, producing nearly double that of the next closest regions, Indiana and California. In addition, 15 of the top 20 manufacturers of class 3 medical devices are located in Puerto Rico. 99% of all the pacemakers in the world are manufactured in Puerto Rico.

How Did Puerto Rico Become a Significant Pharmaceutical Manufacturing Hub?

In 1976, the United States Congress passed the Tax Reform Act of 1976 to help make Puerto Rico a more attractive destination for business. The Tax Reform Act of 1976 impacted Puerto Rico, Guam and the U.S. Virgin Islands, all United States territories. Working in combination with Puerto Rican tax law, the corporate subsidiaries of manufacturers that were based in Puerto Rico were not required to pay corporate taxes as long as the companies distributed their profits as dividends. Pharmaceutical manufacturers listed in Section 936 of the Internal Revenue Code reaped considerable benefits from this provision and were able to notably decrease their tax burden by basing manufacturing operations in Puerto Rico.

This created a manufacturing boom which lasted until 2006 when the tax break was phased out. Over time, the global pharmaceutical manufacturing industry dispersed to

Industry consolidation, job cuts and automation resulted in job loss however the pharmaceutical industry remains strong in Puerto Rico. Companies now do pay higher taxes than they did previously, however it is often a lower rate than they pay in the States, depending upon their company model.

Today, Puerto Rico is the home base for 49 pharmaceutical companies as well as 70 manufacturers of medical devices.

Many of the largest businesses in the pharmaceutical industry established production facilities in Puerto Rico including:

- Pfizer

- Bristol-Myers Squibb

- Merck

- Mylan

- Eli Lilly and Company

- Amgen

The pharmaceutical industry in Puerto Rico has proven to be resilient with global reach. It exports to over 80 countries, is the only source for numerous popular drug products and medical devices and produces 11 of the world’s top 20 drugs including Lyrica, Humira and Enbrel.

The Pharmaceutical Industry in Puerto Rico Plays a Vital Role in the Production of Drugs for the United States

America relies on Puerto Rico for many key medical products

08%

Many critically important medical products – which include sophisticated drugs, biologics, and medical devices – are manufactured in Puerto Rico.

The drugs and devices include:

Conclusion

The Covid19 pandemic has focused attention on a persistent problem. Today, industry trends indicate that there is a growing concern regarding the increased pharmaceutical production offshore and the stranglehold that India and China have on the United States in terms of drug products, especially active pharmaceutical ingredients. Industry news continues to show both worry and a need to develop strategies to coax pharmaceutical manufacturers back to the United States.

Congress is readying bills for consideration to encourage the return of pharmaceutical manufacturing operations back to the U.S. Additional efforts are being strategized including more focus on manufacturing innovation using emerging technologies such as continuous manufacturing and 3D printing. In today’s highly competitive landscape, pharmaceutical manufacturers are leveraging advanced manufacturing technologies to enhance drug product safety and drug delivery, personalize medicines for optimal results and improving product quality. The future of pharmaceutical manufacturing may be at hand in the Food and Drug Administration’s Emerging Technology Program.

Another industry update involves the idea of returning a tax incentive to Puerto Rico, a major pharmaceutical manufacturing hub, to onshore manufacturing operations back to America. Numerous major companies with manufacturing operations are already situated in Puerto Rico.

Aside from drug discovery, research and development, a surge in manufacturing innovation in the pharmaceutical industry and return of pharmaceutical manufacturers to the United States would mean a resurgence in high paying, skilled jobs for the workforce and make the Food and Drug Administration’s oversight of drug quality and drug safety easier. The future of the pharmaceutical manufacturing industry may depend on it.

What Makes Datex Different?

1. Revolutionary low code/no code flexible workflow-driven warehouse management software

2. Most configurable, user-friendly WMS on the market today

3. End-to-end solution provider: software, hardware, EDI, and managed services

4. White Glove Concierge Service

5. Executive-level attention and oversight

Industry Specific WMS

Resources

https://www.washingtonexaminer.com/policy/economy/manufacturing-hungers-for-workers

https://www.advisory.com/daily-briefing/2020/05/20/coronavirus-update

https://www.pacificresearch.org/wp-content/uploads/2020/04/BuyAmerica_F.pdf

https://www.foxnews.com/health/pharmaceutical-industry-china-drug-production

https://hbr.org/2020/04/bringing-manufacturing-back-to-the-u-s-is-easier-said-than-done

https://www.dol.gov/newsroom/releases/eta/eta20200218

https://www.newsmax.com/us/peter-navarro-medicines-foreign-dependency/2020/03/16/id/958523/

https://www.statnews.com/2020/05/26/panic-pharma-buy-american-manufacturing-us/

https://www.industryweek.com/the-economy/article/21132824/puerto-ricos-pharma-push

https://pharmaboardroom.com/articles/did-you-know-puerto-rican-pharma-manufacturing/

https://www.fda.gov/emergency-preparedness-and-response/mcm-issues/advanced-manufacturing

http://phrma-docs.phrma.org/files/dmfile/PhRMA-AdvMfg-Chart-Pack—FINAL.PDF

https://universityventures.com/images/publication259-PuertoRicoHCLSReview-22-47.pdf

https://www.pharmamanufacturing.com/articles/2018/puerto-rico-pharma-battered-but-unbroken/

https://www.congress.gov/114/plaws/publ255/PLAW-114publ255.pdf

https://www.cfr.org/in-brief/coronavirus-disrupt-us-drug-supply-shortages-fda

http://www.pridco.com/industries/Pages/Pharmaceutical.aspx

https://www.biospace.com/article/senate-bill-supports-u-s-pharma-manufacturing/

https://www.manufacturing.net/technology/blog/21137742/todays-new-tech-hub