How the Ukraine Russia War Impacts Global Trade and China's Vision

Will the Ukraine Conflict Hinder China’s BRI Plan to Increase Global Trade?The Russian invasion of Ukraine beyond the Ukrainian border into cities along railways and along the Black Sea bring new worries into closer focus. How will Russia’s invasion of Ukraine impact trade and the supply chain across the world? Let’s first take a brief look at one of Ukraine and Russia’s primary trading partners, China.

China and Trade with Ukraine

Yes, the war in Ukraine will and already has caused significant supply chain disruption and likely will continue to do so for the foreseeable future. Not only was a nation’s security damaged, but also its infrastructure and likely its long-term ability to have an effective supply chain logistics industry.

The importance of Ukraine to China involves its geographic location: Ukraine is an important node in the Belt and Road Initiative.

What is the Belt and Road Initiative?

It All Started with the Ancient Silk Road

In ancient times, from 206 BC to 220 AD, the Chinese Han Empire worked to expand trade to the west, initially to Central Asian countries. Over time, the ancient Silk Road was extended, enabling trade between Europe and China. Silk, spices, and jade were traded with other countries and China bought glass, gold, and other noble metals.

During the period between 618 to 907, the Arab conquest of Central Asia during the Tang Dynasty interrupted this trade route. Tang trading outposts were attacked and trade between the East and the West declined. As the Mongols conquered vast areas across Eurasia, trade again began to blossom. However, during the years of 1279 to 1368, the Yuan Empire was overtaken by the Mongols. Over time the warring kingdoms along the Silk Road route came under Mongol control. This served to stabilize the ancient trade route, making it safer to traverse between Europe and East Asia.

From 1644 to 1912, the Manchu Qing Empire aligned with the Mongols and rose to power, providing them with the power to control the Silk Road routes. At this time, however, the evolution of navigation technologies and ship construction had led to increased maritime trade rather than through overland trade routes. Because of this, the Central Asian countries became isolated, and their economies suffered and failed to develop.

China’s Belt and Road Initiative: The New Silk Road

Chinese President Xi Jinping proposed that a new Silk Road begin construction in 2013, combining both overland routes, known as the “Belt” and sea routes, known as the “Road”. The Belt and Road Initiative, commonly referred to as BRI, is designed to promote global cooperation and to foster economic development along the routes. This global infrastructure development strategy involves Chinese investment in more than 70 countries and is considered the centerpiece of President Xi Jinping’s foreign policy. In geopolitical terms, BRI would facilitate China to take on a greater leadership role globally, coinciding with its rising power and status. BRI serves to provide China with a platform for its global commercial activity, expanding trade, Chinese influence and partnerships.

The Belt and Road Initiative is a multi-billion-dollar infrastructure investment platform designed to provide ultra-modern connectivity on a trans-continental scale. Expanding the connectivity across continents will facilitate market access to developing countries across Asia and Africa, enabling them to advance their economies and so that more opportunity can be provided to their citizens and countries.

BRI encompasses the land-based Silk Road Economic Belt, a 21st Century Maritime Silk Road and a Digital Silk Road. One of the key objectives of BRI is to not only promote Chinese information and communications technology (ICT) supply chain which includes hardware, optical cable, and satellite networks but also to encourage the coordination of economic policy, facilitate investment and trade, resolve disputes, stimulate cooperation in research and development and more. This comprehensive plan is also designed to expand the use of the Chinese credit information system and currency.

The aspiration is to have infrastructure including energy, ICT, manufacturing, and transportation vertically integrate with Chinese production supply chains, service infrastructure, technology, and transportation networks. This would provide China with significant benefits including the ability to:

- Create new and expand existing markets for its goods and services

- Enable it to offload excess industrial capacity

- Expand its state firms’ presence outside the country

- Secure access to foreign sources of agriculture, energy, and strategic commodities

- Employ Chinese workers outside its borders

The “One Belt” route extends to the Baltic Sea, across Central Asia and Russia and traverses the Mediterranean Sea via Central Asia and Western Asia and to the Indian Ocean via southwest China.

Ukraine and BRI

BRI is intended to facilitate the flow of goods from the Ukrainian port city of Chornomorsk, near Odessa using railway and sea routes to Georgia, Azerbaijan, and Kazakhstan to be transported to China. This part of the trade route was developed to ensure that European and Ukrainian goods would be able to reach Central Asia even if the Russian government imposes sanctions.

Ukraine has an unmistakably important strategic position across the railway, roadway and energy pipelines that connect the Russian Federation to the rest of Europe.

China agreed to assist Ukraine in the development of railways, roadways and other infrastructure developments and Chinese investors have been pouring in $2 billion USD annually for the past three years to help ease congestion and develop supply chains.

Following its agreement to be part of China’s Belt and Road Initiative, Chinese companies upgraded Ukraine’s ports and subways. With respect to expanding connectivity within Ukraine’s territorial borders, Kyiv signed a memorandum of understanding with Huawei Technologies in 2020. Huawei developed Ukraine’s mobile network, won a 2019 contract to build a 4G network for the Kyiv subway and agreed to cooperate with Ukraine’s technical security agency on cybersecurity and cyber defense.

On November 30, 2021, Ukraine blocked all rail shipments transiting the country from entering Poland, due to a major infrastructure construction project. Ukrainian Railways blocked all shipments with transit through Ukraine from 15 countries including China and Russia to Poland. This occurred during the period when Ukraine had been requesting diplomatic help from the United States and EU in dealing with concerns regarding potential Russian threats.

To date, the relationship between China and Ukraine has been up and down, as China has lobbied for geopolitical influence in Ukraine, while it attempts to take advantage of the high-end Soviet defense systems and technology Ukraine owns. For its part, Ukraine-China relations have been problematic at times. Ukraine’s stand on Chinese and in-country human rights abuse is one that caused friction. At times this has involved Ukraine making statements of appeasement to its largest trading partner, sanctioning Chinese individuals and entities and acting as the location of anti-China protests.

A Brief Look at Selected Chinese Investments in BRI Partner Ukraine’s Infrastructure

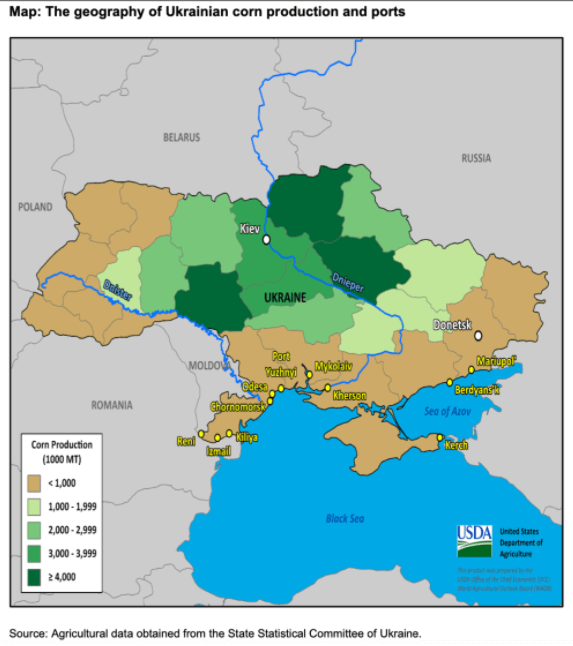

2016: COFCO Group, the largest Chinese food processor, trader, and manufacturer (a Chinese state-owned food processing holding company) constructed a $75 million grain and oil transfer terminal at the port of Mykolaiv on the Black Sea in Ukraine. The Ukrainian location is of strategic importance as it provides both overland and maritime access to the Black Sea, connected to the Mediterranean through the Bosporus as well as the Red Sea by way of the Suez Canal. COFCO is also investing widely in Ukraine, cooperating with local governments as well as city authorities to improve transportation routes around its assets as well as infrastructure.

2017: Chinese engineers completed the upgrade of Ukraine’s busiest port, Yuzhny near Odessa.

2017: Two Chinese firms were awarded the contract to construct a fourth subway line in Kyiv. The contract includes a special provision. Two Chinese companies must help the Ukrainian government to raise funds for the project in Chinese financial institutions. The cost of the fourth subway line in Kyiv is $1.3 billion.

2018: DTEK, Ukraine’s largest private power producer working in partnership with China Machinery Engineering Corp (CMEC) agreed to construct one of Europe’s largest solar generators in the central Ukrainian region of Dnipropetrovsk. Completion was scheduled for the end of 2018 for this facility, the third largest in Europe in terms of potential output.

2018: Ukrainian WindFarm and Chinese company PowerChina agreed to build a wind power station in Donetsk Oblast. With a capacity of 800 megawatts, the wind power station is projected to become the largest wind farm in Europe, excluding offshore wind farms. Project cost was established as at least$1 billion.

Beyond BRI: China and Ukraine

The key to the relationship with both the Ukraine and Russia and direct trade with China is food security.

Many people are unaware of one of China’s most significant challenges: its scarcity of arable land. Only 12.8% of the total land area in China is arable. With a population of 1.402 billion people as of 2020, that presents quite a problem.

Approximately one third of China’s corn imports are from Ukraine and this is used to feed the pigs that constitute a staple meat in that country. Although China does import wheat and barley from Russia, most of China’s wheat and rice are grown domestically, limiting the impact of supply chain disruption for these products.

15% of China’s total oil imports are from Russia, making it Russia’s largest trading partner for the past ten years. Mineral and energy products are the main products imported by China. In 2021, China exported $68 billion of products to Russia and imported $79 billion in goods. This equals three percent of imports and two percent of exports for China. Ukraine exports iron ore and corn to China.

Ukraine-Russia-China Trade Facts

China Trade with Ukraine and the Russian Federation

- 2019 China replaced Russia as Ukraine’s largest trading partner

- China is the top importer of barley and iron ore from Ukraine

- Ukraine is China’s largest corn supplier

- Ukraine is second only to Russia in supplying arms to China

- China’s first aircraft carrier is a refurbished Soviet aircraft carrier purchased from Ukraine

On March 9, 2022 as the Russian military tried to proceed with devastating force within the borders of Ukraine, Ukraine banned the export of wheat and other food staples. The decision was made to conserve specific food items to feed the Ukrainian forces and general population. Banned exports include:

- Wheat

- Oats

- Millet

- Buckwheat

- Sugar

- Cattle and other meats

- Meat byproducts from cattle

The surging upward pricing and lack of supply for these vital grains depended upon for nutritious sustenance across the world is bound to cause significant upheaval. To date in 2022, wheat is up almost 68%. It rose last week over 40%, the biggest weekly rise on record. Banning Russian food goods will also create a shock in the market. Russia and Ukraine’s conflict will undoubtedly cause ripple effects across the globe.

Conclusion

Whether you read the Washington Post or New York Times, get the news on foreign affairs on BBC News, social media or ABC News, Russia’s invasion of Ukraine is playing out in real time day and night. Sanctions on Russia’s elite and President Vladimir Putin as well as other significant targets are likely to have unintended consequences, including to the supply chain logistics industry, transportation, and global trade.

For example, Ukraine recently announced that it was banning major food exports. As Ukraine is a major part of the “breadbasket of Europe”, this rang got immediate attention from the United Nations, which monitors food supply around the globe. Experts at the United Nations are already sounding the alarm of the pending danger of a hunger crisis in various areas around the world.

This is not even addressing the fact that Russia’s invasion has caused oil prices to increase rapidly, leading the White House to reach out to oil producing nations in the Middle East and Venezuela for relief and resupply to ensure each nation’s security and ability to function. Issues involving the energy supply chain and foreign affairs are complex and will be addressed in a separate blog.

As Ukrainian President Volodymyr Zelenskyy, Ukrainian soldiers and its citizenry, bolstered by White House, European Union and its allies using sanctions and other tools, the world waits for the conflicts in Ukraine to end. Until then, Russian attacks on nuclear power plants, civilians and public buildings and the Ukrainian military will consume the world’s attention.

After two years of dealing with the global COVID-19 pandemic, supply chain disruptions, military build ups, shortages, worker resignations and other upheaval, the added shock, heartbreak, and devastation of Russian aggression within the Ukrainian territorial borders, the world is exhausted and waiting for the next shoe to drop.

What Makes Datex Different?

1. Revolutionary low code/no code flexible workflow-driven warehouse management software

2. Most configurable, user-friendly WMS on the market today

3. End-to-end solution provider: software, hardware, EDI, and managed services

4. White Glove Concierge Service

5. Executive-level attention and oversight

Industry Specific WMS

Resources

https://www.themoscowtimes.com/2022/03/04/russia-and-ukraine-chinas-trade-partners-in-numbers-a76759

China’s “One Belt, One Road” Initiative: Economic Issues (congress.gov)

https://www.nytimes.com/explain/2022/03/09/business/gas-oil-russia-ukraine

https://www.card.iastate.edu/ag_policy_review/article/?a=78

Chinese firm to build $1 billion wind farm in Ukraine – KyivPost – Ukraine’s Global Voice

Ukraine’s DTEK, China’s CMEC to build one of Europe’s largest solar projects | Reuters