Amazon, Food Retail E-Commerce & Last Mile Delivery

How Amazon & Whole Foods are Changing Grocery & the Food Supply ChainToday we live in a much more complicated ecommerce and omnichannel world, where we expect fast, low cost abundant delivery options, including sameday delivery. Consumer expectations and customer demands have certainly changed. To final destinations near and far, consumers ordering online can select from options including deliver to parcel locker, home delivery, pick up at store and other choices during the delivery process, and all at the click of a button. Thirty years ago, did anyone imagine that any of this would be possible?

In case you have not yet heard, Amazon bought Whole Foods earlier this year. Yes, Whole Foods has had a reputation as a “Whole Paycheck” destination. Pairing with technology super giant Amazon is likely to change that. Given Amazon’s history as a market disruptor and the Whole Foods’ affluent customer base, this acquisition seems to be a win-win for both companies simply on its face.

But the acquisition of Whole Foods goes far beyond that.

With Whole Foods, Amazon is gaining valuable assets including 431 supermarkets and 91,000 employees in the United States, Canada and UK as well as a foothold into an industry that thus far, has somewhat eluded them. This acquisition also provides critical information that can help Amazon advance beyond its competitors.

Amazon, Last Mile Delivery and the Retail Food Industry

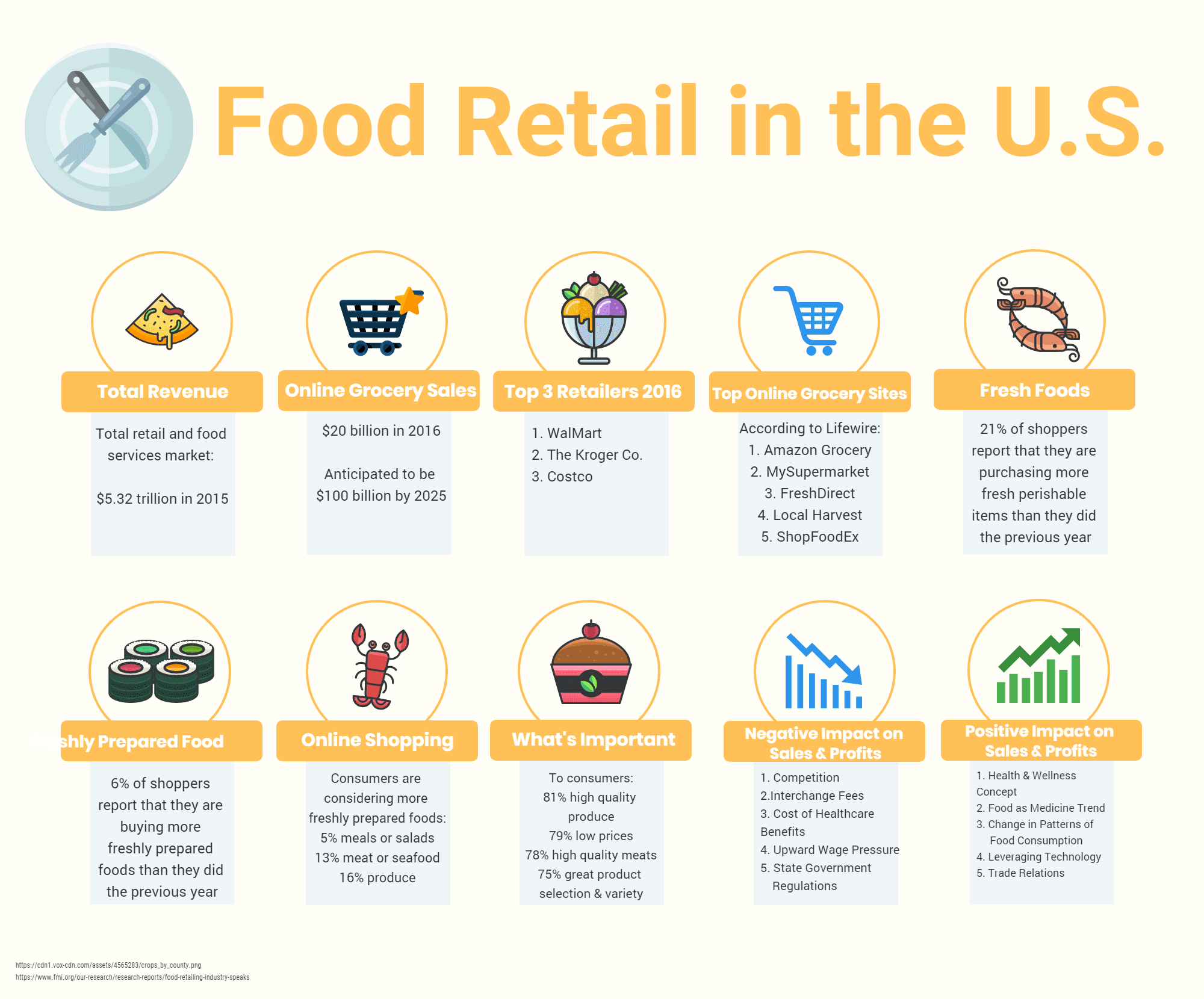

You may not realize this, but the food retail industry is broken. Designed to meet the needs of consumers in past decades, yesterday’s supply chain and logistics networks were developed when consumers purchased more processed foods, those with longer shelf lives. Today, consumers are increasingly more interested in fresh and freshly prepared goods. Consumer trends indicate continued interest towards locally sourced food products, especially those that are organic, non-GMO and produced in a sustainable, ethical, environmentally-friendly manner.

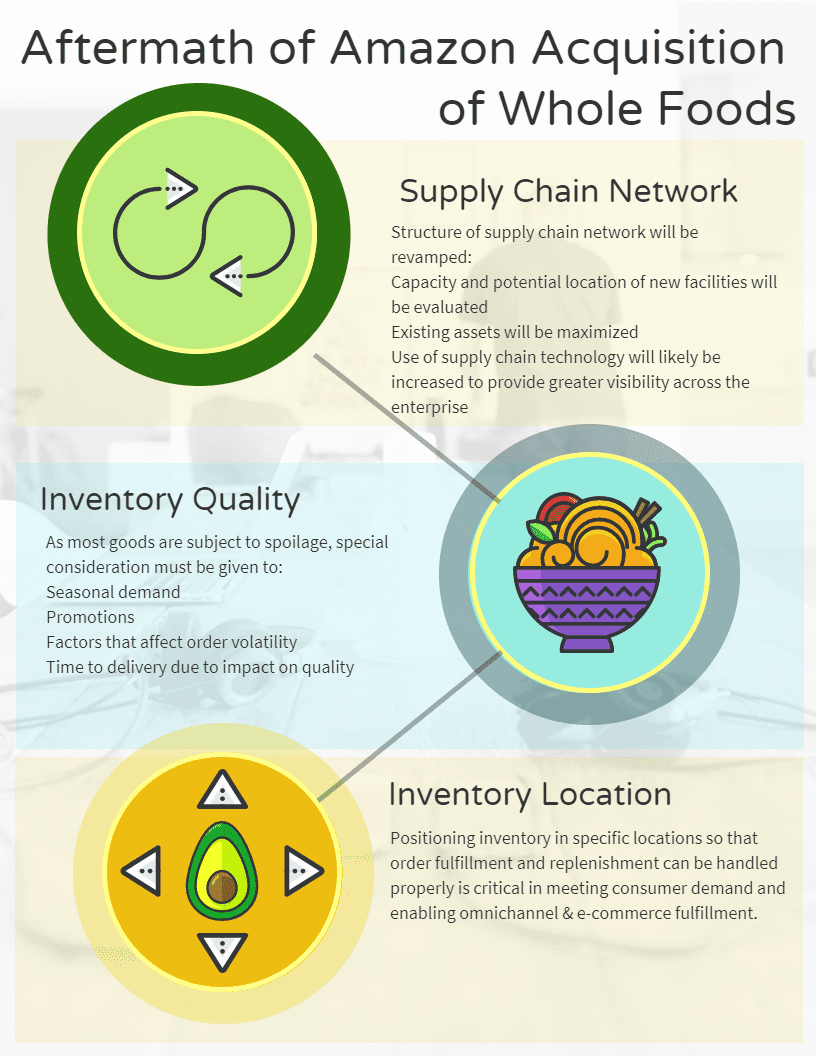

Bringing fresh goods to market when they are susceptible to damage and spoilage can be challenging. This is especially true when fresh foods are being transported to consumers for home delivery quickly. To help solve this challenge, Amazon has envisaged the Whole Foods store locations differently, within a regional or neighborhood framework to aid in the distribution process. This can help to reduce the time, cost and challenges of

Additionally, Amazon is poised to utilize a combination of technology and new supply chain and logistics strategies to expedite distribution to retail brick-and-mortar grocery stores and consumers’ homes.

The eighth largest food chain in the United States, Whole Foods tends to attract consumers who are often “foodies”. Whole Foods shoppers are quality-oriented and are willing and able to pay a fair price for their food products and other goods. These consumers are often health or fitness conscious and like to support businesses that adhere to proper ethical, environmentally friendly and sustainable business practices. In terms of customer age, consumers 18-30 are most likely to shop for food at Whole Foods regularly. When determining new store locations, Whole Foods concentrates on areas with higher levels of the per capita population with college degrees rather than simply higher incomes. A working parent between the ages of 30 and 50 is considered to be a key customer for Whole Foods. Whole Foods shoppers also tend to live in urban environments rather than in rural or smaller communities.

Now let’s take a look at the demographics of Amazon versus Walmart shoppers. Amazon shoppers tend to be older, wealthier, childless and better educated, especially when compared with those of retail giant Walmart’s clientele. 63% of Walmart shoppers are young women, nearly half of whom have children. Nearly half the customer base is under the age of 34. Compared with Amazon shoppers, few Walmart consumers attended graduate school or earn over $100,000 annually.

What do shopper demographics have to do with Amazon’s acquisition of Whole Foods? EVERYTHING.

By purchasing Whole Foods, Amazon gained a valuable foothold in the brick-and-mortar space with an ideal target audience for its major offering, Amazon Prime. This enables Amazon to penetrate the grocery retail industry by gaining insight into the minds and buying patterns of their ideal customers-an affluent shopper who has disposable income and lives in an urban environment-the typical Amazon Prime delivery zone.

Amazon has significant:

- Economies of scale

- Web presence

- Experience with delivery operations and home delivery

- Knowledge of and use of technology

- Distribution capabilities

- Back office operations

Pairing this with Whole Foods would give the grocery chain a fresh, new competitive advantage in the crowded grocery space and provide Amazon with a treasure trove of consumer data and access to Whole Foods’ private label brand products. With the continual expansion of ecommerce, having access to customer centric data and buying patterns is the dream of online retailers.

Why is this consumer data so valuable? It provides insight into grocery habits and patterns, preferences, information that correlates purchases of different products and varying categories. Because people tend to buy food every week, information on these habitual, frequent purchases is highly desirable. Having access to such information would enable Amazon to tailor the experience of grocery shopping to each individual consumer and incorporate it with consumables and other products that it sells. This information can help Amazon to present offers at precisely the right time such as when a consumer is likely to run out of their favorite breakfast food, for example.

Data from more affluent, urban consumers is especially significant and valuable to Amazon. These consumers have more disposable income and provide Amazon with greater potential to “upsell”, i.e. to offer extra products that complement the items the consumer purchased. This increases the total value of the sale.

As Amazon has been working on growing their ecommerce grocery business with only limited success thus far, having access to this critical data can enable them to expedite this growth and to offer a group of products to these key consumers. The data also can be helpful in shaping the delivery process, “white glove” fulfillment options and customer experiences with their brand.

Extension of Last Mile Delivery Options

Consumers are impatient and unconcerned about transportation and logistics challenges associated with fulfilling orders quickly. Amazon and Whole Foods are now at the crossroads of

Coupled with the fact that Whole Foods stores tend to be positioned within affluent areas, Amazon now has a way to optimize its last mile delivery strategy. By leveraging these new assets, Amazon can easily extend its distribution for all kinds of deliveries, including to parcel lockers, enhancing its physical infrastructure measurably. This will make it easier to deliver orders within one or two days as their business grows.

By utilizing the newly acquired Whole Foods’ physical store locations, Amazon can quickly create a network of locations for in-store

What Else is Amazon Likely to Change?

Potential changes are on the horizon as a result of the Amazon acquisition of Whole Foods. This includes:

- More price reductions in products sold at Whole Foods due to reduced costs generated by economies of scale, improved supply chain logistics operations, use of technology and other factors

- Integration of Amazon Prime into the Whole Foods shopping and buying experience

Positioning of Amazon Lockers at Whole Foods locationsPositioning of Whole Foods private label brand products on Amazon- Potential integration of Amazon’s artificial intelligence agent Alexa into grocery shopping and delivery

Conclusion:

In this environment of vast transportation networks, talk of drones and autonomous vehicles for last mile delivery, Amazon has crafted an elegant strategy for bringing goods closer to consumers to help ensure fast, low cost delivery is standard to enrich customer experiences. From the beacons of San Francisco across the country, Silicon Valley continues to look for new ways to use technology throughout the supply chain and across transportation networks.

The acquisition of Whole Foods provides Amazon with rich, valuable data that will undoubtedly lead to enhanced strategies, integration of Amazon products for its extensive customer base and a longer reach. Consumers can also look forward to lower food prices at Whole Foods and a wider array of fulfillment and delivery options.

Be advised food retailers. Amazon continues to bring positive disruption and facilitate change and has now come….to a store near you.

What Makes Datex Different?

1. Revolutionary low code/no code flexible workflow-driven warehouse management software

2. Most configurable, user-friendly WMS on the market today

3. End-to-end solution provider: software, hardware, EDI, and managed services

4. White Glove Concierge Service

5. Executive-level attention and oversight