Semiconductor Supply Chains, 3PLs, and The CHIPS Act

Ever since the pandemic created disruptions to supply chains around the world, semiconductors have become a hot topic. The importance of semiconductor chips is underscored by their use in everyday life. They are the fourth-most traded product in the world, only behind crude oil, motor vehicle parts, and refined oil. In fact, a record 1.5 trillion semiconductor units were shipped in 2021, a 26.2% increase from 2020. Even as record numbers of chips are being shipped, however the price of chips has increased up to 15% due to supply chain challenges and the rising cost of raw materials. Therefore, it is crucial to improve each function of semiconductor manufacturing to ensure that the semiconductor supply chain and global supply chains runs efficiently.

A Look at Semiconductor Supply Chain Issues

Semiconductors are used in a wide array of products typically used every day, including computers, cell phones, ATMs, communication and electronic devices, trains, entertainment devices such as gaming consoles as well as in vehicles. There are several factors that have contributed to the global semiconductor shortage. The current chip shortage began in early 2020 when the COVID-19 pandemic erupted and strained supply chains around the globe.

There was an increase in demand for semiconductor chips as the world’s digital transformation hastened. Children began to go to school online and the number of employees that work from home increased. The demand for consumer products such as gaming consoles, smart phones, and other electronic devices rose as well. In addition, the automobile industry’s rebound worsened the shortage. During the pandemic, car manufacturers lowered their semiconductor chip orders in response to a downturn in sales. When they finally placed their orders again, chip manufacturing facilities that were in operation were already behind in production.

The global shutdown halted semiconductor manufacturing facilities at the beginning of their processes. Fabrication facilities that had to go offline took months to resume wafer production. This was detrimental to global supply chains because it can take more than 6 months to fill chip manufacturing inventory pipelines from start to completion. In addition, some wafer fabrications can take an additional 20 weeks.

Historically, semiconductor supply chains have been designed to use lean manufacturing for efficiency. Lean manufacturing is a method that focuses on minimizing waste within manufacturing practices while maximizing efficiency. Lean manufacturing is beneficial in driving costs down; however, it is susceptible to disruptions when abrupt shifts in the market occur.

Over the years, companies in the semiconductor supply chain have designed their operational processes around lean manufacturing and just-in-time inventory warehousing strategies so that goods do not need to be stored for long periods of time. Both methods are cost-effective and efficient when supply chains are without shortages. Businesses that use the just-in-time strategy depend on the capabilities of lean manufacturing facilities to increase or decrease production in order to properly manage current and prospective inventory levels. The events from the past two years disrupted chip production, subsequently affecting inventory supply. This has contributed to the semiconductor shortages that the world faces today.

.

Semiconductor Supply Chain Segments

In the age of the Internet of Things and 5G, chips drive global economic advancement. The U.S. semiconductor industry makes up 39% of the total value of the global semiconductor supply chain. Nations that are allied with the U.S., such as Japan, Europe, Taiwan, and South Korea make up a total of 53%. Together, these countries have a competitive advantage in several supply chain segments in which they specialize.

These segments are:

- Research and Development

- Production

- Design

- Manufacturing

- Assembly, testing, and packaging (ATP)

- Semiconductor manufacturing equipment (SME)

- Materials (wafers)

- Electronic Design Automation (EDA)

- Core IP

- Distribution

Did You Know?

Semiconductor materials can partially conduct electrical current between insulators (non-conductors) and conductors (usually metals). The name “semiconductor” describes the fact that it has electrical resistance and cannot fully conduct electricity. A semiconductor can be a pure element such as geranium or silicon or a compound, for example, cadmium selenide or gallium arsenide. Without semiconductor technology, products stemming from technology and machinery industries cannot be produced.

The most complex parts of the semiconductor supply chain are the design, fabrication, and SME processes. The U.S. is a leader in research and development however it lacks foundries for chip making. South Korea specializes in production and produces materials and SME while Taiwan dominates chip manufacturing and ATP. Japan specializes in SME and materials while also producing semiconductors for use in older semiconductor technology. Europe specializes in SME, materials, and core IP.

The Foundry Model of Semiconductor Supply Chains

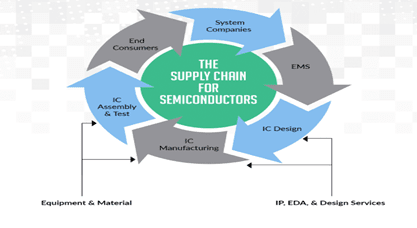

The semiconductor supply chain involves many processes that need interdependence from a multitude of companies. All these steps are necessary to keep the semiconductor supply chain functioning and efficient. The semiconductor supply chain is a network of companies that can be broken up into stages. These stages are known as the foundry model.

The Foundry Model

-

-

- Design – fabless semiconductor companies and electronics makers design chip requirements

- Foundries are contracted to produce the designed ships.

- Front-end manufacturing – Silicon engines or wafers are processed and formulated into dies.

- Back-end manufacturing – Chips are assembled and packaged for placement in circuit boards

- End-product integration – Semiconductor chips are integrated into consumer electronics to create the end-product

- Consumption – End-products are shipped to companies, retailers, and consumers

-

Semiconductor Supply Chains and 3PLs

The semiconductor industry is unique because it works through various companies with specialized capabilities. Propelled by digitalization and consistent technological progression, the success of the semiconductor industry depends on a predictive and responsive supply chain.

To create manufacturing and logistics efficiency, semiconductor makers are relying on 3PLs and logistics service providers to help produce a high-powered supply chain. This is beneficial to 3PL companies, however the decisions that semiconductor companies make to choose which 3PL to use is complex. Listed are criteria that chip manufacturers use to make their decision on 3PL service providers.

3PL Expertise

3PLs and other types of logistics service providers must have expert-level understanding of the requirements of the semiconductor supply chain. 3PLs and LSPs should be able to integrate services that can address:

-

-

- Specialized transportation

- Compliant packaging

- Inbound hazardous materials

- High-value and sensitive goods handling

-

Moore’s Law refers to Gordon Moore’s belief that the number of transistors on a microchip doubles every two years, though the cost of computers is cut in half. Moore’s Law states that it can be expected that the speed and capability of today’s computers will increase every couple of years, and that the cost will be reduced. Another tenet of Moore’s Law asserts that this growth is exponential.

Moore’s Law refers to Gordon Moore’s belief that the number of transistors on a microchip doubles every two years, though the cost of computers is cut in half. Moore’s Law states that it can be expected that the speed and capability of today’s computers will increase every couple of years, and that the cost will be reduced. Another tenet of Moore’s Law asserts that this growth is exponential.

Due to the nature of the semiconductor supply chain, 3PLs and LSPs should have global capabilities that span major cities and remote populations. In the case of semiconductor supply chains, 3PLs that understand each market’s regulations and have the ability to operate in Foreign Trade Zones can be vital to their success. 3PLs and LSPs must be able to react to the uncertainty of the semiconductor market. By adapting supply chains to achieve the proper speed and flexibility, 3PLs can succeed when market conditions and consumer demands change. 3Pls should offer logistics solutions that can:

-

-

- Combat sudden shifts in demand

- Increase time-to-market

- Offer multiple modes of transportation

- Mitigate risks

- Provide end-to-end supply chain visibility

-

3PLs Need to Continue to Invest in Technology

In the third party logistics service industry, technology is the great differentiator. 3PLs that embrace and leverage technology are better positioned to help their customers:

-

-

- Reduce labor and warehouse operating costs

- Automate processes including inspections and quarantines

- Provide specialized handling and storage for sensitive goods to prevent damages

- Properly handle and storage hazardous materials

- Specify the storage location of goods to meet product requirements

- Facilitate the necessary visibility and use of data across warehouse operations and the supply chain

-

A supply chain as intricate as the semiconductor industry needs specialized global logistics services that can support every function of the semiconductor value chain. It is imperative that 3PLs and LSPs invest in technology to create and keep a competitive advantage

In August, the Biden administration signed The CHIPS and Science Act into law. The bill will invest more than $200 billion into the U.S. semiconductor industry over the next five years. It is aimed at positioning the U.S. as a leader in semiconductor chip manufacturing, which will help to lower costs and prevent future supply chain challenges. Investment in research, development and the semiconductor workforce are key inclusions in the bill.

$52.7 billion for chip manufacturing and research

- $39 billion over five years to build, expand, and modernize semiconductor manufacturing facilities and equipment in the U.S.

- The Department of Commerce will receive $11 billion for semiconductor research and development and workforce development to ensure there is a strong enough labor force to fill the projected manufacturing jobs.

- $1.5 billion for the Public Wireless Supply Chain Innovation Fund. This fund is designed to enhance U.S. telecommunication companies to better compete with Chinese companies.

- 25% tax credit to companies that invest in semiconductor manufacturing equipment or facility construction

- Recipients of investment funds are prohibited from expanding chip manufacturing operations to China for 10 years to increase global competition

$170 billion for scientific research and innovation

- Creation of the National Science Foundation Directorate for Technology, Innovation and Partnerships. This organization will handle driving U.S. development in:

- Artificial intelligence

- Quantum computing

- Advanced manufacturing

- 6G communications

- Energy and semiconductor materials science

- Fund the construction of regional technology hubs throughout the country. These hubs will specialize in:

- Advanced manufacturing

- Next-generation communications

- Computer hardware and pharmaceuticals

- $13 billion to STEM educational scholarships and fellowships. These funds will be focused on improving access to STEM education in sparsely populated and rural areas.

Worldwide Semiconductor Facility Construction

Most semiconductor chip manufacturing facilities are located in Asia. According to the Semiconductor Industry Association, Taiwan and Korea make up 83% of global processor chip production and 70% of memory chip output. In the wake of global semiconductor supply chain issues, chip makers have plans to construct more than 30 fabrication facilities. The cost of these fabrication sites is expected to cost over $140 billion, with all of them set to begin construction by the end of 2022. China and Taiwan are constructing the majority, with eight each.

Upcoming Fabrication Facilities in the U.S.

Intel

Intel plans to invest over $40 billion into new semiconductor fabrication facilities in Arizona, Ohio, New Mexico that will go online by 2026.

Arizona

- Fab 52 and Fab 62 in Chandler, Arizona. These fabs cost $20 billion and are set to come online in 2024.

Ohio

- Two unnamed facilities are set to be built in Columbus, Ohio. This project has an initial cost of $20 billion, however it is expected to cost over $100 billion over a ten-year period. This ten-year period will culminate with the sites holding eight chip fabrication plants. Experts believe that the creation of these facilities will foster improvement across the entire U.S. semiconductor supply chain.

New Mexico

- Intel is constructing an advanced packaging facility in New Mexico. This facility will enable Intel to manufacture advanced semiconductor designs, which the company predicts will be popular within the decade. This facility is set to open in 2024 with an initial cost of $3.5 billion.

TSMC

The world’s largest contract semiconductor manufacturer is coming to America with plans to construct a fabrication facility in Phoenix, Arizona. Titled Fab 21, the facility will have the capacity of 20,000 wafer starts per month and will go online in 2024. Experts hope that the construction of this facility will enhance the nation’s semiconductor industry by improving access to suppliers and talent for the projected workforce.

GlobalFoundries

GlobalFoundries plans to construct a chip fabrication site in Malta, New York. The facility will specialize in advanced semiconductor manufacturing technologies.

Samsung Foundry

The company has committed to building a fabrication facility in Taylor, Texas. The site will cost $17 billion and is expected to come online in 2024. The facility will produce semiconductor chips for applications that include:

- 5G

- Mobile

- High-performance computing

- Artificial intelligence

Samsung also plans to build 11 additional facilities in Austin, Texas and Taylor, Texas, with an estimated cost of $192 billion. These sites are projected to become operational starting in 2034 and continue through 2042.

Texas Instruments

The company plans to build a $30 billion fabrication facility in Sherman, Texas. The construction of the facility is expected to last at least ten years.

The Semiconductor Manufacturing Workforce

According to Eightfold AI, the U.S. will need to increase its semiconductor workforce by 90,000 semiconductor employees to fill the projected semiconductor jobs. This is a near 50% increase from the current 102,000 semiconductor employees in the U.S. Currently, the U.S. only produces 10% of the world’s chip supply. Due to this fact, experts believe that a shortage in labor could derail the U.S. government’s plan to become a world leader in semiconductor manufacturing.

In partnership with Intel, the U.S. National Science Foundation plans to invest $10 million into the semiconductor workforce. This investment will provide funding to develop all chip production processes. It will also be utilized to:

- Enhance semiconductor engineering technology

- Implement advanced semiconductor manufacturing education and training

- Provide equitable STEM education at colleges and universities

Conclusion

Semiconductors are necessary to power devices that consumers and businesses need in everyday processes. The advent of IoT, 5G, electric vehicles, and mass digitization have created a demand for semiconductor technology that has never been seen. Without semiconductor technology, global economies would potentially crumble. The global semiconductor chip shortage has been the catalyst to generate supply chain disruptions throughout the world.

The combination of reduced supply of semiconductor materials and increased demand for semiconductor devices has led to product shortages and price increases. As the demand for chips rises, semiconductor companies and governments are in global competition for better strategic positioning. Investment into the semiconductor supply chain is necessary to combat supply chain disruptions in other industries and increase global competition. Each process in the semiconductor supply chain, from semiconductor research to sourcing semiconductor material for semiconductor product manufacturing, is important.

The Biden administrations passage of CHIPS Act will provide incentive programs for the construction of American semiconductor manufacturing facilities. The federally funded semiconductor incentives will provide private companies and federal agencies with loan guarantees. In return, investment funds must be used to improve U.S. semiconductor ecosystems, progress American competition and innovation, and increase the semiconductor manufacturing capacity in the United States. CHIPS Act funding will also be used to enhance semiconductor supply chain security by funding semiconductor workforce development as well as research and technological advancement. By consistently improving semiconductor facility standards and technology, semiconductor supply chains will eventually bounce back.

What Makes Datex Different?

1. Revolutionary low code/no code flexible workflow-driven warehouse management software

2. Most configurable, user-friendly WMS on the market today

3. End-to-end solution provider: software, hardware, EDI, and managed services

4. White Glove Concierge Service

5. Executive-level attention and oversight

Industry Specific WMS

Resources

Why a Resilient Supply Chain Matters to Semiconductor World (birlasoft.com)

What is an integrated circuit (IC)? A vital component of modern electronics (techtarget.com)

CHIPS bill: Here’s what’s in the bipartisan semiconductor chip manufacturing package | CNN Politics

The Semiconductor Supply Chain – Center for Security and Emerging Technology (georgetown.edu)

Visualizing The Global Semiconductor Supply Chain (visualcapitalist.com)

Outsourcing Semiconductor Operations? 4 Questions to Ask Your 3PL (epsnews.com)

A Holistic Approach to Strengthening the Semiconductor Supply Chain – Global Trade Magazine

Why The Chips Are Down: Explaining the Global Chip Shortage | Jabil

Record-Level Semiconductor & Component Price Increases in 2021 (z2data.com)

Results from Semiconductor Supply Chain Request for Information | U.S. Department of Commerce

The Semiconductor Supply Chain and the Global Chip Shortage | ZhenHub

The Semiconductor Supply Chain and the Global Chip Shortage | ZhenHub

Ford doubles down on lean in the face of semiconductor shortage | Supply Chain Dive

The Semiconductor Crisis Should Change Your Long-Term Supply Chain Strategy (hbr.org)

Understanding the Current Global Semiconductor Shortage, Preparing for the Future | IHS Markit

The Semiconductor Supply Chain – Center for Security and Emerging Technology (georgetown.edu)

A holistic approach to strengthening the semiconductor supply chain (brookings.edu)

Semiconductor logistics — Dimerco

Global semiconductor unit shipments 2021 | Statista

Chip fabs are coming to the U.S., but will there be enough skilled workers? | Fierce Electronics

U.S. Semiconductor Renaissance: All the Upcoming Fabs | Tom’s Hardware (tomshardware.com)

Industry Group Launches Platform to Grow Semiconductor Industry Workforce (businessfacilities.com)

Global chipmakers to break ground on 29 fabs by 2022: report (koreaherald.com)

Deloitte: The end of the semiconductor shortage is near | VentureBeat

A 2022 Guide to the Global Supply Chain Crisis | ZhenHub

Semiconductor Shortage May Be Here to Stay – DevOps.com

Lean Manufacturing: How It Disrupted the Global Supply Chain | ZhenHub

Semiconductor industry worldwide by application | Statista

Biden to sign bill to boost chipmakers, compete with China Aug. 9 -White House | Reuters

How the U.S. Can Reshore the Semiconductor Industry – Eightfold

These 169 industries are being hit by the global chip shortage (yahoo.com)

GPU Market Pricing Back in Uptrend, Shattering Expectations of Price Normalization | TechPowerUp