How The Diesel Fuel Shortage is Impacting Global Supply Chains

Learn everything you need to know about diesel fuel and how the global shortage is affecting supply chains

The diesel fuel shortage is affecting supply chains of nearly every industry, and subsequently the quality of life around the world. Farmers in the Midwest United States are struggling to turn a profit while politicians in the Northeast are lobbying for emergency home heating fuel reserves to prepare for winter. In the Southeast U.S., a major supplier of diesel, Mansfield Energy, recently announced that their pumping terminals were running out of fuel. Many of the company’s supply trucks have been forced to drive from fuel station to fuel station to fill their orders.

Most of the products that we use are transported by trucks, airplanes, rail, and cargo ships. In addition, construction, farming, and military equipment also utilize diesel fuel. It is also used to heat homes. According to the American Automobile Association (AAA), the average price of diesel fuel in November 2022 is $5.33 per gallon, nearly $1.80 more than one year ago. As the price of fuel goes up, so does the cost of shipping and transportation.

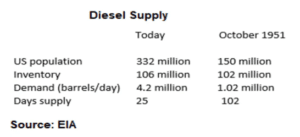

According to the Energy Information Association (EIA), as of November 4th the U.S. had the equivalent of 26 days of diesel fuel supply. This is up from 25.8 days of supply left, reported on October 28th

What is Diesel Fuel?

Diesel fuel is a mixture of hydrocarbons created by the distillation of crude oil and biomass materials. It was invented by German engineer, Rudolph Diesel, in 1892. Also called diesel oil, the combustible liquid is used as fuel for diesel engines. Unlike gasoline, which is ignited by a spark, diesel fuel is ignited by being injected into hot compressed air in diesel engine cylinders. Diesel fuel releases more energy on combustion than gasoline and provides better fuel economy than gasoline engines. According to the U.S. Department of Energy (DoE), diesel engines are 30 to 35 percent more efficient than gasoline engines.

Diesel fuel normally costs less than gasoline because it takes less steps to produce. Before 2006, diesel fuel produced greater quantities of pollutants such as sulfur and carbon dioxide than gasoline. Since that time, the U.S. Environmental Protection Agency (EPA) issued mandates requiring refineries to reduce the amount of sulfur in diesel fuel used in the U.S.

Type of Diesel Fuel

Clear Diesel

The most common type of diesel fuel is clear diesel, commonly called road, highway, or automotive diesel. This type of diesel is for vehicles that travel on public roads as well as marine vessels.

Dyed Diesel

Dyed diesel fuel is used specifically for agricultural and off-road use. It is illegal to use dyed diesel in vehicles that are operated on public roads. Dyed diesel fuel comes in a variety of colors. Red is most often used in construction and farming equipment while purple is often used in aviation fuels. Military equipment diesel fuel is typically dyed blue.

Diesel Exhaust Fluid (DEF)

In 2010, the EPA issued a mandate requiring diesel vehicles to use ultra-low sulfur diesel fuel. To achieve this, all new diesel engines sold in the U.S. had to be equipped with selective catalytic reduction systems. These systems use diesel exhaust fluid to dissolve pollutants in diesel fuel such as nitrogen oxide and sulfur. Every 50 gallons of diesel fuel requires one gallon of DEF to meet diesel fuel regulation standards.

Why is there a diesel fuel shortage In America?

In the past two years, the global diesel fuel market struggled to satisfy global need. Many countries made plans to switch to biofuel solutions while drilling companies simultaneously slowed diesel fuel production. Diesel fuel suppliers are blaming supply chain disruptions and regulations for the diesel shortage. The U.S. Energy Information Administration (EIA) has reported that the U.S. currently has the lowest stockpile of diesel and other distillate fuels since 1951.

The EIA has also reported that total distillate (diesel, jet fuel, heating oil) inventories are at their lowest levels since 2008. Experts believe the current crunch in supply is the result of a variety of things including:

- Reduced refinery capacity

- A ban on Russian imports

- Increase in domestic demand

- Continued exportation of American diesel fuel

- Federal regulation limiting U.S. production

U.S. petroleum refineries produce an average of 11 to 12 gallons of diesel fuel from each 42-gallon barrel of crude oil.

Reduced Oil Refinery Capacity

During the winter months, crude oil refineries typically undergo maintenance so refinery capacity drops. In addition, several U.S. refineries have closed in the past two years due to COVID-19 related issues. The closing of U.S. refineries has reduced U.S. diesel fuel production by 6% or nearly 1 million barrels per day. Because there is a limited amount of production capacity for diesel fuel in the winter months, companies are scrambling to find fuel to last.

In 2020, six oil refineries with a combined distillation capacity of 801,000 barrels of oil per day closed. A Canadian refinery in Newfoundland, Canada that supplies the Northeast also closed. Since then, five other refineries with a total distillation capacity of 408,100 barrels have halted operations.

Due to federal regulations like the Clean Air Act and Renewable Fuel Standard, the costs to construct and operate a refinery are not worth the investment for some companies. The RFS requires refiners to blend biofuels into the national fuel pool each year to reduce greenhouse gas emissions.

The high costs associated with refineries have led to a lack of growth in the industry. In 1977 there were 250 refineries throughout the nation. Today, less than 130 are in operation. The closures and lack of growth have resulted in a shortfall in the ability to produce diesel fuel amid surging global demand. Typically, refineries cost between $5 billion and $6 billion to construct. However, costs have ballooned. For example, Mexico’s newest refinery project is expected to cost between $16 and $18 billion.

Delta Airlines purchased Pennsylvania-based refinery Monroe Energy a decade ago, making it the first airline to acquire a refinery. The intention of the purchase was to save on jet fuel costs; however, the company is now helping to mitigate the impact of fuel price volatility by capturing value from fuel production through the use and sale of finished diesel distillate products. To improve profit margins and reduce environmental liability, the company has begun to import raw materials like soybean oil that will be used to produce jet fuel and other distillates. Producing jet fuel for their own use and having the option to sell it to other companies will help Delta enhance their supply chain networks and give them a competitive advantage in air cargo transportation.

Agricultural Industry

Diesel engines power most of the agricultural equipment around the world. This equipment is necessary to plant, cultivate & harvest crops. It is also vital to the shipment of these crops.. The rise in diesel fuel price due to the shortage is threatening to break its links, however. Unlike major retailers like Walmart who are their own logistics service providers, farmers either utilize third party logistics companies or transport their own goods to customers. Because of this, the food supply chain network is facing a major hurdle in the face of the diesel fuel shortage.

Soybeans provide a good example of the effect that the fuel shortage is causing. Soybeans are used to produce ultra-low sulfur diesel that meets EPA regulatory standards. The importation of soybeans from various countries comes as soybean farmers in the American Northeast face supply chain constraints because of the country’s fuel shortage. Farmers need diesel to grow, harvest and transport crops. If farmers cannot produce soybean crops, they cannot get soybean products to oil refineries, limiting refinery capacity to produce diesel fuel.

Unlike the distillate supply shortage of 2008, experts say that the current fuel shortage is much worse. Demand of diesel fuel and other distillates typically rises in the spring when farmers are planting crops and the fall when crops are harvested, and people begin to prepare for winter. In 2008, distillate levels were low at the end of spring, while in 2022 distillate levels are low in the fall. In fact, reported inventory levels in October were the lowest since 1982. This is unlikely to have an impact on harvest, however there will be higher shipping costs to move products by truck and rail, translating to higher consumer prices.

Compounding this issue are the low water levels of the Mississippi River. Barge transportation along the river moves 70 million tons or 47% of the total grain destined for export per year. Barge traffic is currently only one way because there is not enough water to allow simultaneous upstream and downstream towing. Barges are also traveling with reduced volumes because of the low levels. In addition, several barges important to the food supply chain are not in operation, forcing farmers to load goods at different sites. The increases of shipments at certain inland ports along the Mississippi River has created bottlenecks, resulting in delayed shipments to processing facilities and grocery stores. Experts predict that if the diesel fuel shortage continues, a food crisis may result.

Transportation Industry

The preferred means for cargo transportation changes when the current means becomes less profitable. Domestic shipping companies are now shifting to rail transportation instead of trucking since rail usage is low and fuel costs are high. An imminent rail strike is threatening to disturb already fragile supply chains, however. A strike would disrupt nearly 1.7 billion tons of goods from being transported, dealing a $2 billion per day blow to the U.S. economy. If a rail strike occurs, freight will need to be shipped by truck, however there may not be enough fuel to ensure timely product delivery.

A strike would also cause a massive reduction of supply in distillates such as DEF. Currently, Union Pacific railroad is not transporting DEF at full capacity due to a labor shortage. Union Pacific accounts for 20% of the nation’s highway diesel fuel supply and 30% of the DEF supply.

This has already affected the largest network of travel centers in the U.S., Pilot Flying J. Because Union Pacific has reduced their rail capacity, Pilot has been forced to reduce shipments of diesel fuel to their terminals by 26%. The company expects to reduce shipments another 50% in the coming months. Pilot Flying J supplies the trucking industry with over 300 million gallons of DEF. Of that, 74% is moved via railway. Without Union Pacific’s full rail capacity, the entire trucking industry will be affected, with sidelined trucks reducing trucking capacity around the nation. This will limit raw material and product delivery for manufacturing, warehousing, and ecommerce industries.

U.S exports of distillate fuel reached a record 1.76 million barrels in September 2022, with more than 633,000 barrels of diesel sent to Northwestern Europe.

Exportation of Diesel Fuel

The Jones Act requires any cargo that is shipped between U.S. ports to be carried by U.S. ships with American crews. Due to this Act, it is more profitable for oil refiners in the U.S. Gulf Coast to export distillates to other countries than it is to ship to the East Coast. There are currently only 55 Jones Act tankers being used. As a result of the small number of tankers available to transport energy, the price to book a Jones Act tanker is double that of a foreign one.

This has led American companies to export more than a million barrels of distillates a day to European and Latin American countries. At the highest levels since 2019, the diesel fuel exportation is crippling U.S. supplies, even as European diesel fuel imports are being diverted to America.

Recently, two oil tankers were diverted from Europe to the U.S. because of the skyrocketing price of diesel fuel and the strength of the American dollar. Thundercat, loaded in the Middle East, and Proteus Jessica, loaded in Singapore, recently arrived in New York. The tankers carried a combined 90,000 tons of diesel fuel. Two other tankers, the Sea Caelum and Hellas Tatiana are also expected to be diverted from European countries to the U.S.

In addition, some American refineries are producing and exporting distillates that are not up to U.S. standards. When EPA regulations on sulfur began in 2006, some companies chose to continue their production and exportation of high sulfur diesel fuels to countries with less strict fuel regulations.

Russian Sanctions

One of the most impactful reasons for the diesel fuel shortage are the sanctions levied by the Biden Administration against Russia. Russia is the world’s second biggest producers of oil and natural gas products. The European Union and Asia rely on Russia for a steady supply of diesel fuels. The U.S. is less dependent on Russian oil than other countries, however the impact on supply chains is already being felt. Prior to the Russian invasion of Ukraine, the United States imported close to 700,000 barrels of Russian crude oil and petroleum products per day. The majority of the imports boosted diesel fuel supplies in the U.S.

As winter approaches and the European Union (EU) ban on Russian petroleum looms, American truckers and farmers will have to compete with Europe for U.S. diesel. 90% of the EU’s import volumes are diesel and experts predict the EU must replace nearly 2 million tons of Russian diesel imports. Compounding this stress is a future increase in demand, which experts are predicting could be between 300,000 to 500,000 barrels during the winter.

China’s importation of U.S. oil and gas is also affected by the EU’s Russian sanctions. Chinese vessels are having to travel greater distances to transport crude oil and distillates to European nations. Consequently, these vessels are occupied for longer durations, delaying their return to service. This has not only increased the cost of shipping American oil to China, but also led to a shortage of ships to move diesel products. In addition, the cost to ship diesel products from the Middle East to Japan has doubled since 2020. These circumstances are threatening Asian economies that depend on U.S. diesel imports.

Optimizing the Supply Chain with Technology

Digital supply chains are the future, having end-to-end visibility has never been as important as it is today. Technologies are transforming supply chain processes from linear to an integrated model in which information flows in multiple directions to the supply chain.

You may be wondering how the diesel fuel shortage is affecting the transition from traditional to digital supply chains. Due to the shortage, fuel prices continue to rise dramatically. This makes it difficult for companies to predict how costs will impact their day-to-day operations. Advanced technologies can not only capture real-time fuel inventory at oil tank terminals, but also can be used to optimize loading operations.

Artificial intelligence and cloud technologies make it easier to collect, evaluate, and store data, providing enhanced visibility into operations. This plays a vital role in increasing the speed of deliveries as well keeping the customer informed about product delivery if companies are faced with issues stemming from the diesel fuel shortage

One of the ways that technology is used to improve efficiency is by optimizing driver behavior to reduce fuel usage. Companies collect data from technologies connected to the Internet of Things such as GPS trackers and accelerometers. This data can help companies identify driving patterns and behaviors, which can help to reduce fuel usage. For example, each year 1 billion gallons of fuel are consumed due to semi-truck idling. With fuel prices skyrocketing, this can be costly for businesses. Data analytics can be used to eliminate unnecessary fuel consumption by enabling companies to develop plans to mitigate bad driving habits.

Route optimization is also extremely important to reducing fuel costs. Artificial intelligence in GPS systems can be utilized to automatically identify traffic, roadblocks, or inclement weather and direct drivers to faster and safer routes. Technology can also be used for more efficient fuel stops. With route planning technology, fleet managers can find out where the cheapest fuel is available and update driver routes to coincide with fuel terminal locations.

In 2021, diesel fuel consumption was approximately 46.82 billion gallons, an average of 128 million gallons per day. This amount of diesel fuel accounted for:

- 77% of total U.S. diesel fuel consumption

- 15% of total U.S. petroleum consumption

- 25% of total energy consumption by U.S. transportation sector

Here are some facts about diesel fuel. Diesel is used to:

- Power over two-thirds of all farm equipment in the U.S.

- Transport 90% of all products in the U.S.

- Pump one/third of all water in the U.S.

In addition, diesel powers 96% of intermodal trucks, 80% of ocean and nearly 100% of freight locomotives and marine barges.

Conclusion

A storm has come to the diesel fuel supply chain. Reserves of diesel fuel and other distillates have dwindled to record-low numbers. A drought of the Mississippi River has reduced the use of barges and pushed product shipments to rail and truck. This has helped drive a surge in prices that is not expected to stop anytime soon.

Diesel fuel drives the economy and without it, industries all over the world are more prone to supply chain disruptions. Without diesel fuel, the global economies would collapse in a matter of days.

Optimizing the supply chain amid a diesel shortage is essential. Companies and consumers cannot afford operational inefficiencies amid current fuel supply and demand volatility. As fuel becomes more costly, the cost of cargo movement will continue to rise. This will cause further delays and bottlenecks for multiple industries, affecting the flexibility of business logistics. To remain profitable and meet customer expectations, future supply chain networks will have to find alternative opportunities. Companies can utilize the power of intelligent data analytics to ensure resilient supply chains.

Companies such as Delta Airlines leverage vertical integration by operating activities across the full value chain. One step involves producing their own distillates and selling them to other companies.

The diesel fuel shortage has several implications for supply and demand. For example, the diesel shortage is affecting farmers’ ability to harvest crops, care for livestock, and ship goods. When more of the supply goes to one purpose, such as transporting goods, less product is available for other needs, such as agricultural production.

Effective supply chain management involves building and maintaining connections to ensure that companies are properly resourced. With proper resource planning, supply chain partners produce and deliver goods to customers. In the age of e-commerce, companies must meet customer expectations and improve customer satisfaction to be successful.

What Makes Datex Different?

1. Revolutionary low code/no code flexible workflow-driven warehouse management software

2. Most configurable, user-friendly WMS on the market today

3. End-to-end solution provider: software, hardware, EDI, and managed services

4. White Glove Concierge Service

5. Executive-level attention and oversight

Industry Specific WMS

Resources

How Much Diesel Is Left? Shortage Fears as East Coast Supplies ‘Very Low’ (newsweek.com)

High diesel prices present trouble for greater supply chain (newsnationnow.com)

Delta Air Lines’ Refinery Is Reportedly Preparing To Process Biofuels | TravelPulse

Diesel Exhaust Fluid shortage a scary reality for the supply chain, agriculture | Ag News | hpj.com

Diesel Fuel | Definition, Efficiency, & Pollution | Britannica

What is Diesel Fuel (dieselnet.com)

Rising Diesel Prices Could Mean Trucker, Supply Chain Shortage (jalopnik.com)

Diesel prices top trucking industry’s critical issues list – FreightWaves

Experts say 25 day supply on-hand does not mean diesel shortage (kltv.com)

Mississippi River Levels Hit Lowest Depths Since 1980s – MFA Oil

Diesel market in perfect storm as prices surge and supplies dwindle (cnbc.com)

Supply Chain Disruption Will Continue According to Logistics Report | Blueberries Consulting

What Does “Diesel Shortage” Really Mean? – Mansfield Energy Corp

Use of diesel – U.S. Energy Information Administration (EIA)

Diesel fuel explained – U.S. Energy Information Administration (EIA)

Why every American should care that diesel prices are surging across the country – FreightWaves

Experts say diesel shortage could have a major impact on economy – WFMJ.com

Diesel market in perfect storm as prices surge and supplies dwindle (cnbc.com)

Mississippi River Levels Hit Lowest Depths Since 1980s – MFA Oil

What are some Impacts of Rising Fuel Costs on Logistics (eisneramper.com)

3 Different Types of Commercial Diesel Oil and Their Uses (sperrs.com)

China Could Ease Europe’s Diesel Shortage | OilPrice.com

Diesel shortage fears grow for small businesses across Georgia (walb.com)

Putting America’s Diesel Situation Into Perspective | MarketMinder | Fisher Investments

Experts Are Talking Of A Fuel Shortage: How Will It Affect Aviation? (simpleflying.com)

Increased fuel prices affecting airline ticket prices (blackhillsfox.com)

How airlines could adapt to rising fuel prices | McKinsey

Jet fuel costs skyrocketing with supply shortage on the East Coast – WHYY

China’s diesel fuel exports more than doubled in September | Reuters

Europe imports more diesel from MidEast, Asia to replace Russia | Reuters

Diesel fuel shortage ominous – Odessa American (oaoa.com)

Diesel Fuel – an overview | ScienceDirect Topics

How One 3PL Is Taking On Higher Fuel Costs | 2022-03-30 | SupplyChainBrain

Diesel shortage could impact holiday prices (abcactionnews.com)

Value chain and products (cenovus.com)

Dynamic Supply Chain Network Design for Diesel Fuel Consumption IIO-02.pdf (sadio.org.ar)

Digital supply chain model in Industry 4.0 | Emerald Insight

Rep. Ted Budd Calls Out Biden Over Diesel Fuel Shortage | U.S. Congressman Ted Budd (house.gov)

US Exports More Diesel as Global Shortage Fuels Competition | Transport Topics (ttnews.com)

Shift to Specialty Fuels—A Driving Force to Build Resilient Supply Chains (powermag.com)

Fuel prices on the rise affecting supply chains | Maersk

Supply Chain Resilience Guide (fema.gov)

Four ways A.I. can help cut diesel fuel costs (fleetequipmentmag.com)

https://www.api.org/news-policy-and-issues/hurricane-information/oil-natural-gas-supply-chains

Optilogic | The Impact of Fuel and Transportation on Supply Chain…

Utilizing the Power of Data and Advanced Analytics in Oil and Gas Supply Chain | Supply Chain Brain

How businesses can build supply chain resilience – FleetPoint

High diesel prices present trouble for resilient supply chain (newsnationnow.com)

Fuel Surcharges: How do they affect the supply chain? (kellerlogistics.com)

Tim Kraft Discusses the Impact of Rising Diesel Prices | Poole Thought Leadership (ncsu.edu)

Fuel for a More Efficient Supply Chain | Material Handling and Logistics (mhlnews.com)

Benefits of Technology in Supply Chain Management (aeologic.com)

What Rising Costs of Gas Means For Supply Chain | Avetta