Do you know which of your clients is the most profitable? And how can you find out which ones are secretly draining your resources? The answers to these questions lie in warehouse cost analysis, which is the process of assessing client profitability to determine high-value versus low-value accounts.

Neglecting to perform adequate warehouse costing inevitably results in obscured client profitability when seemingly good accounts are actually loss leaders due to hidden costs. The result? Lost profits and dissatisfied customers. To mitigate this risk, third-party logistics (3PL) companies require clear insights into reporting and real-time visibility, which is only achieved through comprehensive warehouse cost analysis.

The following provides a framework for a true warehouse cost analysis that uncovers client-level profitability and empowers strategic decision-making.

A Practical Guide to Granular Warehouse Cost Analysis

The good news: Profitability blindness is avoidable with the right costing approach. Traditional cost analysis stops at averages. Granular warehouse cost analysis goes deeper, showing exactly where your 3PL’s time, labor, and spend are going, and which clients are truly driving profit. With this information, operations leaders can verify which customers deliver the most value and identify revenue gaps.

Here’s how to get started:

Step 1: Identify and Categorize All Warehouse Operational Costs

The first step in preparing a warehouse cost analysis is to clearly break down costs into specific categories. These components should represent the high-level divisions of work needed to complete projects and are typically broken down into four primary categories:

- Handling costs: Labor for receiving, putaway, picking, packing, and shipping

- Storage costs: Cost per square foot/pallet position, including rent, utilities, insurance, and taxes

- Administrative and IT costs: Warehouse management software (WMS) fees, customer service salaries, and management overhead

- Equipment costs: Material handling supplies (forklifts and so on) maintenance, depreciation, and fuel/charging

Step 2: Implement Activity-Based Costing (ABC) for 3PLs

Averaging costs across all clients tends to mask the high-cost-to-serve clients. Fortunately, activity-based costing (ABC) offers a solution for mitigating this challenge. ABC, a method that assigns costs to the specific activities and services a client consumes, is typically executed in a phased approach that starts with defining operational activities and collecting initial data on warehousing direct labor and commodities, followed by collection of distribution costs data, and ending with calculation and allocation of both direct and indirect costs.

According to Investopedia, “ABC introduces multiple cost pools for analyzing overhead and allows indirect costs to be traced back to specific activities.” The result is more straightforward, accurate costing.

The ABC method is based on classifying and designating activities—defined as any event, transaction, unit of work, or task with a specific goal. This system separates activities into five broad levels:

- Batch-level activity

- Unit-level activity

- Customer-level activity

- Organization-sustaining activity

- Product-level activity

While typical cost measurement systems depend on production volume and accumulate all costs in one company-wide pool, ABC allocates indirect or overhead costs to products using classifications that are almost entirely unrelated to the number of units produced. This innovative technique helps to create new bases for assigning overhead costs to goods, so allocation is based on actual productivity—not just on how many units are produced.

Step 3: Calculate Your True Cost to Serve Per Client

The last step is to use these classifications to assign overhead costs to these activities based on their resource consumption. Once a cost driver rate is determined for each activity, you can calculate the client’s total cost by multiplying that rate by the client’s specific usage of those cost drivers.

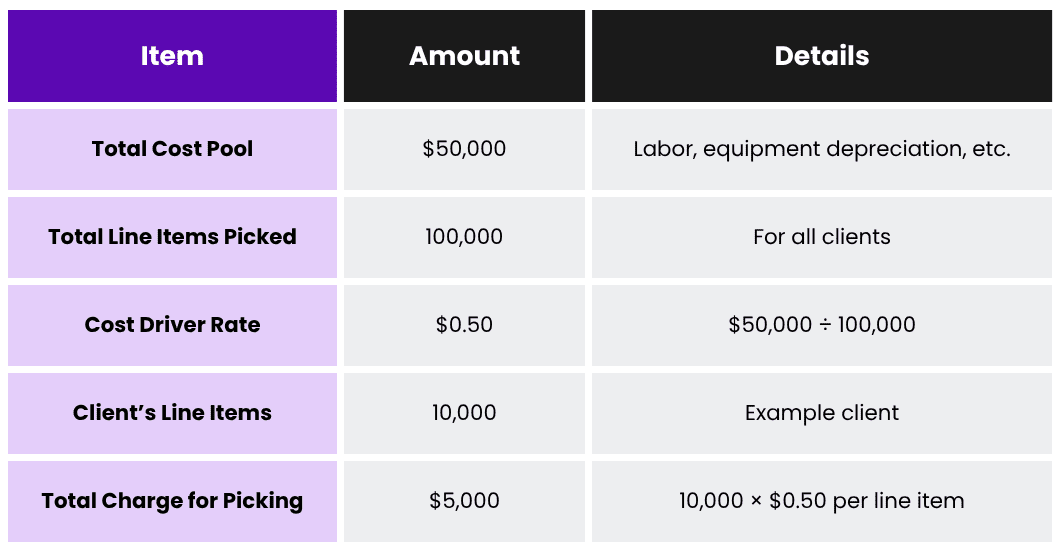

Here’s an example (See image):

If the cost pool for the picking activity (including labor, equipment depreciation, and so on) is $50,000 and the cost driver is the number of line items picked (totaling 100,000 for all clients), the cost driver rate is $0.50 per line item ($50,000/100,000). Therefore, a client who required 10,000 line items picked would be charged $5,000 for the picking activity alone (10,000 line items × $0.50/line item).

Why Traditional Warehouse Costing Fails 3PLs

Generic cost analysis based on averages is insufficient in a complex, multiclient 3PL environment and frequently leads to profitability blind spots. This approach to warehouse costing may work for less ambiguous industries, but 3PL operators often run into obstacles when they forgo more intuitive methods of cost analysis for generic functionalities.

The Illusion of Averages: When Blended Costs Hide the Truth

As mentioned earlier, averaging costs per pallet or per order results in blended costs that obscure individual client profitability. When 3PL leaders rely on averages to determine pricing, the resulting lack of transparency can lead to unexpected fees for customers, processing delays, and billing disputes, affecting client relationships.

The Complexity of Client-Specific Workflows

Across 3PL portfolios, different clients have unique needs that impact costs, including (but not limited to):

- Special handling

- Value-added services (e.g., kitting, labeling)

- Complex compliance requirements

- High return rates

Keeping track of and managing such a broad set of client requirements demands a robust system that leverages automations and integrations to establish a single source of truth and reliably maintain data integrity.

The Challenge of Shared Resources and Overhead

With traditional warehouse costing, shared costs, such as labor, equipment, management, and facility space, across a diverse client base are difficult to accurately identify and allocate. Without a clear understanding of what is being used, by whom, and when, the process of pinpointing and prioritizing resources becomes a jumbled mess of assets and expenses.

Although 3PLs specialize in multiclient operations, managing such a complex client network can only be achieved by employing a WMS that’s capable of handling 3PL complexity. 3PLs that opt for a generic management system that isn’t designed to meet their needs (or dynamic customer requirements) significantly increase their risk of experiencing profitability blindness—an issue that causes a ripple effect throughout the entire enterprise.

The Operational Impact of Profitability Blind Spots

This negative impact goes beyond a few wasted staff hours or some damaged goods on the warehouse floor—it perpetuates all the way through to the client experience and, ultimately, infects your business’s bottom line. When operations leaders submit to profitability blind spots as a result of poor WMS functionality, they risk:

Inaccurate Pricing and Eroding Margins

This leads to underpricing high-maintenance clients and potentially overpricing simple ones, making bids uncompetitive. These discrepancies add up and can quickly erode margins when left unchecked.

Misallocated Resources and Logistical Inefficiency

You can’t optimize labor or equipment allocation if you don’t know where the most effort is truly being spent. Your resources are finite—it’s critical for your teams to be aware of where these resources are going and at what scale to determine the true efficiency of your operations.

Stifled Growth and Flawed Strategic Planning

And finally, without accurate profitability data, making informed decisions about which types of clients to pursue or how to scale the business is virtually impossible. Data is undoubtedly a powerful asset, but only when it’s properly managed and analyzed to develop actionable insights. An abundance of raw data stored and shared haphazardly across the organization limits accessibility and thus, visibility into business performance.

From Invisibility to Insights: How a Modern, 3PL-Specific WMS Provides Clarity

Navigating complex, highly regulated industries, such as 3PL, demands more than generic management software can offer. While a traditional system tends to require workarounds for multiclient operations, a purpose-built WMS is designed from the ground up for 3PL complexity, with features such as:

Granular Data Capture for Every Touchpoint

First of all, a modern WMS tracks every activity (each pick, pack, and putaway) and ties it to a specific client and employee, providing the raw data needed for an accurate cost-to-serve analysis. Customizable dashboards and real-time profitability reporting capabilities allow operations leads to see at a glance which clients are most profitable and which aren’t, moving from reactive analysis to proactive management.

Automated 3PL Billing and Cost Allocation

Furthermore, a 3PL WMS can automatically apply billing rules for every tracked activity, ensuring no service goes unbilled and providing a clear profit and loss for each account. Thanks to built-in multitenancy, this functionality is particularly useful for managing multiple clients—all with their own rules, workflows, and SLAs—in a single facility.

Unified System Integrations

Lastly, a purpose-built WMS keeps your business connected with robust software integration capabilities. From pre-built and native integrations to custom integrations, the WMS’s low-code platform is built on an open API architecture for easy connectivity. This way, a single source of truth powers every touchpoint in your operation. With native electronic data interchange integration support, you can seamlessly connect to your enterprise resource planning software, transportation management system, robotics, or automation system to accelerate onboarding and facilitate future growth.

Take Control of Your 3PL’s Profitability

In the world of 3PL operations, relying on average costs is a recipe for hidden losses. A true warehouse cost analysis, powered by a modern WMS, is the key to unlocking sustainable profitability.

To see the difference the right management software can make for your business, take a self-guided tour of modern warehousing with Footprint WMS.

FAQs: Warehouse Cost Analysis for 3PLs

What is warehouse cost analysis?

What are the main types of warehouse costs?

- Storage costs: Rent/mortgage, property taxes, insurance, and utilities

- Handling costs: Labor for receiving, putting away, picking, packing, and shipping products, plus equipment costs (forklifts and so on)

- Operational costs: WMS software fees, packing supplies, and other consumables

- Administrative costs: Salaries for management, HR, and customer service staff